Chapter President’s Message

Joe Sciulli

Chapter President

MAY 2024

SURVEY RESULTS

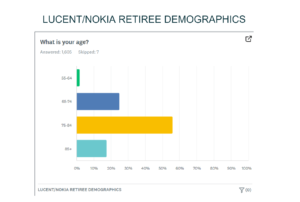

Thanks to all who responded to our survey. Over 1600 responses give us a good representation of our retiree universe.

Lucent Demographics Survey Results

Click here to see some of the results that you may find interesting.

Almost three quarters of the respondents are over the age of 75 and 90% have been retired for over 15 years. If you are younger than that and would like to volunteer a few hours a month, please let me know.

We live in almost every state, but half of us live in New Jersey, Illinois, or Florida. For most, our pension represents a quarter to half of our income. Social Security brings another 20-30%.

For some, the cost of healthcare and healthcare insurance is a major expense. The choice of insurance is important. Many options are available and the analysis can be complicated. But the time and effort taken to “get it right” can be rewarding. We try to provide information to inform your choice on this website. Please review all of your options prior to this year’s annual enrollment.

We asked what your biggest retirement concerns are. As you would expect, the list includes pension safety, costs for medical care and drugs, long term care issues, as well as national political issues. But the concern that was far and away the leader was inflation and no pension increases. If you retired in 1996, you have lost half of your pension’s purchasing power. Retirees with good company pension plans are most susceptible to this because in retirement planning, they relied more heavily on the pension and less on investments. Now that inflation has risen and we are living longer, we can’t benefit from investment funds’ yields. We have requested relief from Nokia in the form of a cost of living raise or a one-time payment using excess pension funds, but have been unsuccessful so far.

ANNUAL FUNDRAISING

We completed our annual solicitation for the Lucent Chapter last month. We want to thank the 11% of Lucent/Nokia members who sent a contribution. Its what keeps us going. If you somehow missed it or have forgotten us, please click here to make your contribution.

Your contribution of $35, $50, $75 or more per year will assist us in pursuing legislation in Congress. NRLN is a non-profit organization. Because NRLN lobbies, contributions to NRLN are not tax deductible. AREF: The AREF is a nonprofit, tax-exempt organization. Donations ARE tax deductible.

WELCOME!

A few hundred members discovered that they were no longer on our mailing list and re-subscribed by going to EMAIL SIGNUP .

Happy to have you back.

SPECIAL NOTICES TO MEMBERS

Lots of Benefits information on our Chapter Benefits Team pages.

Lots of Benefits information on our Chapter Benefits Team pages.

Nokia Benefits Website

Retirees can use the YBR website for benefit-related activities such as:

- Enrolling in Nokia’s health and welfare plans (e.g., medical and dental);

- Making and/or changing Nokia Savings/401(k) Plan elections;

- Updating dependent or beneficiary information

- Projecting pension benefits and/or electing to commence pension benefits.

Nokia Benefits Resource Center (NBRC)1-888-232-4111

International Long Distance 1-212-444-0994

https://digital.alight.com/nokia

Do we have your current email address?

We regularly inform members about important news. If you have mistakenly ‘unsubscribed’ to one of our emails, you will no longer hear from us unless you re-subscribe.

To “re-subscribe”, or to sign up to receive our emails, or if you are not sure we have your current address, CLICK HERE

The entire NRLN 2024 legislative program is available by clicking here. In particular, these issues of interest to our members are being pursued by the NRLN:

![]() Pension Plan De-risking: More companies are doing “de-risking” (Pension Risk Transfer) of their pension plans by purchasing annuities from third party insurance companies. This strips retirees of federal law protections. Foremost among protections that the NRLN wants to become law is our statute proposal that an annuity contract must include full reinsurance of monthly benefit payments. Only a group annuity contract that requires independent, third-party reinsurance with a highly rated insurance company can protect pension plan participants.

Pension Plan De-risking: More companies are doing “de-risking” (Pension Risk Transfer) of their pension plans by purchasing annuities from third party insurance companies. This strips retirees of federal law protections. Foremost among protections that the NRLN wants to become law is our statute proposal that an annuity contract must include full reinsurance of monthly benefit payments. Only a group annuity contract that requires independent, third-party reinsurance with a highly rated insurance company can protect pension plan participants.

![]() Social Security and Medicare would be on the chopping block if “fiscal commission” bills are passed. The NRLN opposes the commissions that would meet behind closed doors to create its cost-cutting recommendations to be “fast tracked” – no amendments in the House or Senate and only yes or no votes. Instead, members of Congress should be held accountable for properly funding Social Security and Medicare.

Social Security and Medicare would be on the chopping block if “fiscal commission” bills are passed. The NRLN opposes the commissions that would meet behind closed doors to create its cost-cutting recommendations to be “fast tracked” – no amendments in the House or Senate and only yes or no votes. Instead, members of Congress should be held accountable for properly funding Social Security and Medicare.

![]() The NRLN continues to lobby members of Congress against the high cost of healthcare shifted to retirees and the unfairness of the chronic illness subsidized benefits that are being denied to 27 million original Medicare Parts A and B participants. NRLN’s proposal equalizes chronic benefits for all over age 65.

The NRLN continues to lobby members of Congress against the high cost of healthcare shifted to retirees and the unfairness of the chronic illness subsidized benefits that are being denied to 27 million original Medicare Parts A and B participants. NRLN’s proposal equalizes chronic benefits for all over age 65.

![]() NRLN wants legislation to end pay-for-delay and other brand-name drugmakers’ tactics that keep generics off the market. We support bills to allow Americans to import prescription drugs from Canada.

NRLN wants legislation to end pay-for-delay and other brand-name drugmakers’ tactics that keep generics off the market. We support bills to allow Americans to import prescription drugs from Canada.

![]() Corporate Mergers: We have gone through the corporate mergers with Alcatel-Lucent and Nokia. The NRLN has developed a whitepaper and is lobbying Congress for legislation to protect retirees in corporate mergers, acquisitions and spin-off.

Corporate Mergers: We have gone through the corporate mergers with Alcatel-Lucent and Nokia. The NRLN has developed a whitepaper and is lobbying Congress for legislation to protect retirees in corporate mergers, acquisitions and spin-off.

How we run our money: Nokia

In the article below, Arto Sirvio, Nokia’s director of pensions, tells Carlo Svaluto Moreolo how the communication and information technology company manages a large portfolio of pension plans. Reprinted from January 2018. In a world where corporate behavior comes under closer scrutiny, the way companies treat current and past employees is critical. Ensuring they are financially secure in retirement is not something that can be overlooked by management boards. But for a company such as Nokia, which has about 100,000 staff and more than 200,000 retired employees, pensions can become a great challenge.

Click here for the full article.

HOW YOU CAN HELP OUR CHAPTER

- Become a Member! Sign up to receive emails from us here.

- Be an active member. Respond to Action Alerts. Congress does listen to what constituents are saying. Your letters supporting NRLN lobbying efforts make a difference. Congress knows that those letters and emails are from retirees trying to protect retirees.

- Reach out to other retirees that you know through clubs, your emails or Facebook. We need them to join us to gain strength. Ask them to sign up for emails here.

- Volunteer your time. We need folks who are a little younger than mid-eighties to help in small ways. It’s time for the next generation — you know, you 60- to 70-year-olds, to step up! If you have HR experience, you could be very helpful in the benefits area. If you think you would like to help, even a few hours a month, email me at lucentchapter@nrln.org.

- Support us financially. Your contribution of $35 or more is important to finance the work of the new chapter. Click here to make your contribution by credit card or send a check to NRLN Inc., and mail to PO Box 69051, Baltimore, MD 21264-9051.

Stay healthy in 2024

This is the time of year for resolutions. For retirees, let me suggest that the most important resolution you can make for the year 2024 is STAY ON YOUR FEET!

This simple phrase has two meanings and they are both relevant.

- First, try to spend more of your time moving around rather than sitting.

- The second, avoid falls. Falls are a main cause of morbidity and disability in the elderly.

More than one-fourth of persons 65 years of age or older fall each year, and in half of such cases the falls are recurrent. The risk doubles or triples in the presence of cognitive impairment or history of previous falls.

Read all about it here.

Another article from the Mayo Clinic outlines some simple tips for avoiding falls.

Cost-of-Living Adjustment (COLA) Information for 2024

Several of you have written me asking about a cost of living raise in the pension. You point out that the pension trust is overfunded, and inflation has taken its toll, particularly on long-time retirees. And it’s true that one dollar in 1990 purchasing power requires $2.73 today.

We have raised the question with Nokia.

Their answer is that there are no plans for a cost-of-living raise. They point out that retirees prior to 3/1/90 do not pay for healthcare and life insurance.

We will keep monitoring the pension trust numbers in 2023.

Joe Sciulli

Chapter President

Joe Sciulli, Vice President – Information Technology/Databases CHAPTER PRESIDENT | Joe began his career with Western Electric in 1957 as a field engineer in the Defense Activities Division, which served as the prime contractor for the SAGE Air Defense System and had responsibility for installation and system testing of the system nationwide. He worked in computer and information technology assignments in Kansas City and Newark, NJ. In 1974 he moved to the Chicago area where he was responsible for the startup of the Niles, MI, Materials Management Center and nationwide planning for Western Electric’s installation force. In 1977, he became Director of Operations for the Central Region, and in 1979 moved to the Denver Works, where he was Director of Manufacturing. In 1982, he became Executive Vice President of the Teletype Corporation in Skokie, Il. Subsequently he served as Operations Vice President for AT&T’s computer business. He has a BS degree in Electrical Engineering from the University of Pennsylvania and attended the Sloan School at Massachusetts Institute of Technology. He retired in 1989 and served as a Director and webmaster for the Lucent Retirees Organization for 18 years. He lives in Elgin, IL.

This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience.

This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience.